The Share Offer – a summary

Buying shares makes you a member and co-owner of the Scottish Cooperative Discovery Centre Ltd. This is a Community Benefit Society registered with the FCA and structured so that a majority of members will always be local residents. The more local members we get, the more investor members from outside we can draw in.

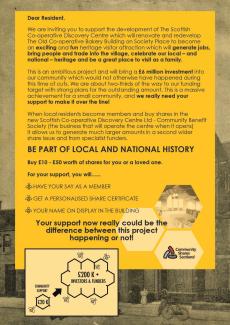

The minimum share purchase is £10, and the maximum is £25,000 (or 10% of total share capital - see Share Offer Document for more detail - if you are interested in making a large share purchase please do contact us on the email below). You may also be interested in reading the project Business Plan.

You must be resident in the West Calder & Harburn Community Council area and be over the age of 16 to buy shares and become a Local Member.

A wider share issue with a target of over £200,000 and a higher minimum share purchase has also been launched. How many outside investors we get depends on how many Local Members we have!

If you you would rather just make a donation please email us here on [email protected] and we will be happy to help.

Each individual, family member or organisation must complete a separate form.

Share offer closes 31st March 2024.

FAQs

Community shares are an equity investment in a community benefit society. They are withdrawable and non-transferable. Put simply, this means that they are a way for community enterprises to raise money. They are a form of investment crowdfunding. Individuals and organisations who support the aims of the Scottish Co-operative Discovery Centre Limited are invited to invest in our business; in return they will become members of the Society plus have the potential to receive interest and to receive their money back once the enterprise is thriving.

Local residents are encouraged to become Local Members and as such there is a lower minimum investment level than for others. The more local members we have, the more outside investors we can have.

The Scottish Cooperative Discovery Centre Ltd is a Community Benefit Society which is a type of business registered with The Financial Conduct Authority. We have set up this type of organisation because it has the ability to raise share capital and encourages experienced and interested people to become involved in running the business while ensuring that the local community retains some control. Its registration number is 9069, was incorporated on 15th May 2023 and has the registered address of West Calder Community Centre, Dickson Street, West Calder, West Lothian EH55 8DZ.

The Society currently has six board members. It has been supported in its incorporation by WCHCDT which will own a community anchor share, but they are legally separate entities. The society’s rules can be seen in full here on the FCA website. More information on the organisation and it's relationship with WCHCDT can be found in the Share Offer Document and Business Plan.

- By becoming a Local Member you enable us to admit another investor from outwith the area but retain control by the local community.

- By investing you will become a Member of the Scottish Co-operative Discovery Centre Limited. This means that you have the right to participate and vote at member meetings and Annual General Meetings. You will therefore be able to influence the direction of the business and contribute to its success. Each Member will have one vote, regardless of the size of their investment.

- We have applied for Advance Assurance from HMRC to confirm that investment in this share offer will be eligible for Seed Enterprise Investment Scheme income tax relief and believe we will qualify. If confirmed, people investing more than £1,000 will be able to be claim 50% of their investment amount as income tax relief (and if they use a capital gain to make the investment, can get 50% reduction in Capital Gains Tax, too). We are happy to discuss this further with potential investors.

- Regular updates on how your support is helping achieve the aims of the centre

- You or your organisation’s name on display in the building.

- A personalised share certificate.

- Members of the Scottish Co-operative Discovery Centre Limited are eligible to stand for election as a volunteer Director of the Society. You are also able to vote in the Director elections at each AGM.

We will encourage all members to volunteer their skills to help the business. We have a number of roles already imagined from tour guides to archivist which will help keep costs down and bring new ideas. Part of the fun and strength of a community led business is active member engagement – either in a short-term or long-term capacity. You can directly and positively impact the Scottish Co-operative Discovery Centre.

Anyone over the age of 16 can invest as can incorporated organisations; but there are certain restrictions. At least 51% of members must be resident in the defined local community of West Calder & Harburn (Community Members) and should the share offer not meet this criterion, then the board may not be able to accept some non-resident investments. This will be done based on investment size. Incorporated organisations can also invest, with a minimum investment of £250 (see also additional FAQ).

The minimum investment by people from West Calder & Harburn is £10; and the minimum for those living elsewhere or for organisations is £250 (although donations would be gratefully received). The maximum investment is £25,000 (or 10% of share capital whichever is lower).

Yes. If that person is over the age of 16, just fill out the necessary section of the online or paper Share Purchase Form. Note though that gift recipients will only become members when they have also accepted the membership terms.

Yes, you can, and we’d be delighted. If you contact us at [email protected] we can arrange to receive a donation. Thank you.

No. Unlike shares in most (limited) companies, community shares cannot be sold, traded or transferred between Members. However, the value of the shares of a deceased shareholder may be transferred to another person in accordance with their wishes.

No. Community shares do not increase in value. However, they could lose some or all of their value should the business not succeed. Remember community shares are primarily designed to support the initiative for the good of the community.

If for any reason, WCHCDT are unable to finish redevelopment of the building to the point where the society can progress business as planned then the value of remaining member share capital will be returned subject to meeting outstanding liabilities.

Our Society has an asset lock, so that in the event of insolvency or winding-up, the proceeds from the sale of assets and our cash would first pay off all our creditors. Any leftover funds would then be used to pay back shareholders’ investments on a pro-rata basis. If there is any surplus after returning funds to creditors and investors, this would be gifted to WCHCDT.

Remember that the building will always be owned by WCHCDT for the community and only leased to the society.

Note also that shareholder personal liability is restricted only to the value of your shares. Nothing beyond that is ever at risk.

It is our aspiration to be able to offer interest on your investment and the ability to withdraw your share capital sometime from year 5 of trading (likely 2031) if the business is thriving and, in a position, to be able to do so financially. It will be the responsibility of the board of directors to decide if this is appropriate.

Remember, community shares are primarily designed to support the initiative for the good of the community.